Summary

DeFi options overview

Aevo - general

main features of options on Aevo

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

What I write simply expresses my personal point of view and does not represent financial advice. But sure, beat me at beer pong and I will tell you the next 100x.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

The options platforms today represent a negligible percentage of the total TVL (Total Value Locked) in DeFi. However, they could potentially climb the ranks and take the top position in the future, significantly distancing themselves from the second position. This is not a question but a reasoned statement based on the analysis of available data.

Why do I say this? Because "mature" markets (also known as regulated markets) are populated by institutional entities that require adequate hedge instruments for the reference asset class. To fully appreciate the quantum leap that the sector could undergo in the coming years, it is useful to observe some data, such as the number of derivative contracts traded worldwide from 2013 to the present, measured in billions.

According to data published by the Futures Industry Association (FIA) on January 25, 2022, the global trading volume of derivatives on exchanges reached $83.8 billion.

To say the least, surreal is the massive volume of notional value generated by over-the-counter derivative contracts (OTC): the unit of measurement is in trillions (a figure that I struggle even to imagine). For comparison, the entire Italian public debt amounts to 2.7 trillion, which is less than 0.5% of the total 🤯

Now that we have observed the weight of derivatives in traditional financial markets, let's examine the state of the art in the crypto world, specifically on the options side. We'll start with the aggregated Open Interest of all available central exchanges (cex), including CME.

The sum of aggregated values on the two most capitalized assets is worth 19.5 billion (covering almost the entirety of overall volumes). This figure, while not insignificant, is infinitesimally small when compared to the mind blowing data on OTC derivative volumes traded in tradFi.

Turning our attention to the available offerings in DeFi (in terms of the representation of DeFi protocols in overall volumes), the numbers become almost embarrassing: the top 10 protocols for Total Value Locked (TVL) and trading volumes cover less than 1% of the total (struggling to surpass 0.5% to be specific).

For most people, the DeFi options category might seem unattractive given the reported discouraging data and the complexity associated with the instrument. However, the potentially boundless room for growth (both in terms of TVL, and the market cap of related governance tokens), along with the underutilization by users, are the elements to explore if the goal is to achieve insane performance.

Let's now analyze one of the most interesting protocols in the "DeFi options" category, implemented by a team (Ribbon) that has been focused for years on developing structured products based specifically on options: Aevo.

Aevo is a decentralized derivatives exchange order book based that offers both perpetuals (perp) and options. It operates on the native network, a custom EVM OP stack-based rollup. On the platform, order matching is executed off-chain, while settlement and contract execution occur on-chain.

On the order book, maker and taker orders are matched; once the matching occurs, they are then published on-chain on Aevo smart contracts. Before each on-chain operation, the off-chain risk engine checks the margin requirements of each account (both in standard and portfolio margin mode) to determine if it has the necessary capital to open the given position.

As we've seen, Aevo smart contracts are deployed and operate on the Aevo network, a rollup EVM based on the OP stack with some custom specifications, including:

a) The sequencer that batches transactions is managed by Conduit, a Rollup As A Service (RAAS) project that is part of the Paradigm ecosystem.

b) The dispute period is only 2 hours, compared to the 7 days of more well-known optimistic rollups (Arb and OP). This means that at least 2 hours must pass before receiving the final confirmation on withdrawals/deposits to/from the Aevo dapp-chain (funds will arrive at the destination in a few seconds, but the operation cannot be considered effectively completed until that time has elapsed).

About options

Contracts on BTC and ETH (the only supported underlying assets at the moment) settle in dollars and expire at 8:00 AM UTC.

The price feed for the two assets is provided by an internal oracle that tracks values reported by various central exchanges (such as Deribit, Binance, Coinbase, GateIO, Bitget, OKX, etc.) and calculates the weighted average (excluding pairs with a deviation of more than 0.5% from the calculated average).

There are three types of fees:

Trading fees → Maker and taker fees are set at 0.03% and 0.05% of the notional volume, respectively, but cannot exceed 12.5% of the contract value in any case.

Settlement fees → The platform charges an additional fee of 0.015%, but only on the buyer and only on contracts that expire "in the money," i.e., beyond the strike price defined by the contract, to facilitate the transfer of money from one party to another.

Liquidation fees → Another fee, equal to 0.2% of the notional, is then applied to positions subject to liquidation.

Leverage is available but only for the selling side and as long as the position complies with the terms outlined by Aevo margin system. The account liquidation risk occurs if the overall value of the account falls below the maintenance margin. The margin system consists of three fundamental parameters:

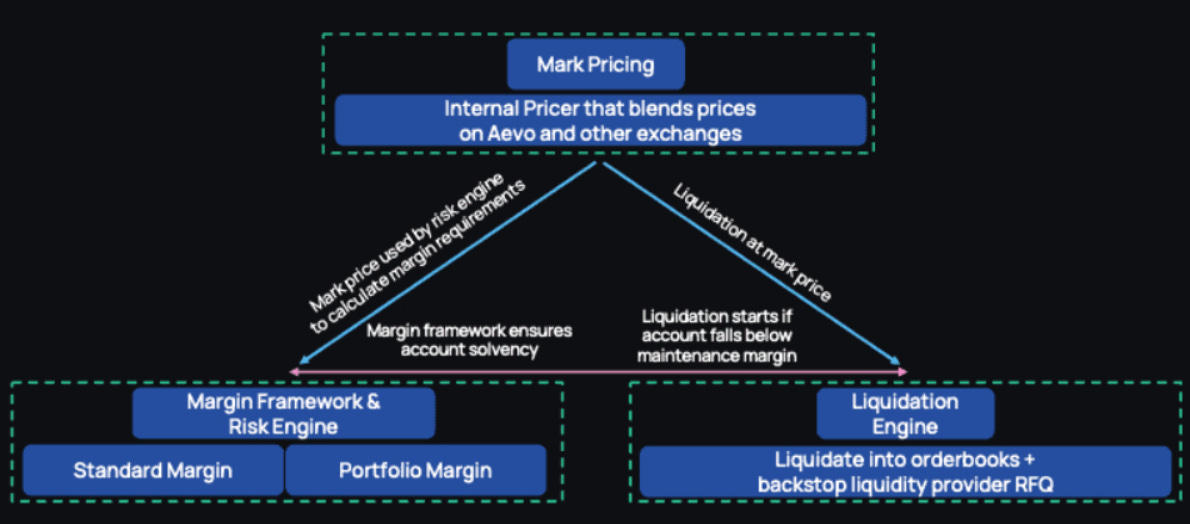

a) Mark pricing

b) Risk engine — Margin Framework

c) Liquidation engine

a) Mark Pricing

Mark pricing is essential as it effectively determines margin requirements and liquidation thresholds necessary to avoid uncollectible credits on all Aevo accounts. As mentioned above, asset price feeds are provided by an internal oracle on the platform that aggregates data from various CEX (excluding all pairs deviating more than 0.5% from the average value).

b) Margin Framework (Risk Engine)

Initial Margin: The amount of margin required to open a position.

Maintenance Margin: The margin amount required to keep a position open, which is lower than the initial margin.

Upon opening each new position, the platform ensures that the trader in question has sufficient capital to operate. The formula adopted to obtain this data is:

AB + UP − OO − IM − MM > 0

where:

AB = Account Balance

UP = Unrealized Profit & Loss

OO = Open Orders (total value)

IM = Initial Margin

MM = Maintenance Margin (of existing positions)

The exchange constantly check existing positions to ensure that they always meet the requirements imposed by the maintenance margin, using this formula:

AB + UP − OO − MM > 0

When the value of the left side of the equation equals 0 (or goes below), the liquidation process begins. The same formula is applied when a user requests a withdrawal to verify that they have sufficient maintenance margin.

Aevo provides two models for portfolio margin management and calculation:

Standard Margin: This is set by default for each account and evaluates the margin of each position opened by the user individually, not holistically (not "global" or overall).

Portfolio Margin: Developed by Aevo, it allows for a reduction in margin requirements, thereby increasing leverage beyond permitted limits, as long as traders using it maintain a properly balanced portfolio, always covered by hedge solutions on short positions. It is calculated based on a risk model that assesses the margin based on positions opened overall by the account, not at the level of a single contract.

Portfolio Margin consists of two fundamental components: a) Scenario Margin and b) Minimum Margin, which are combined to calculate the initial and maintenance margins of the portfolio.

a) Scenario Margin: Represents the core risk of the account's portfolio and is calculated by simulating potential profits and losses in various hypothetical market conditions (more accurately, based on hypothetical and predefined price and IV variations). Aevo evaluates this margin based on 15 different scenarios, each assuming an upward or downward movement in the underlying price and/or option volatility.

The Max Spot Movement and Max IV Shift are risk parameters initially configured by the Aevo team (and possibly in the future decentralized through governance dynamics) for each listed asset (BTC and ETH). These parameters determine, as the name suggests, the maximum extent of movement in both price and IV (Implied Volatility). For ETH, we are talking about a maximum spot movement of around 20%, both up and down, as well as an IV shift of 50% up and 25% down.

The Scenario Margin is thus set to the maximum loss established for that specific underlying asset on the two evaluated parameters (percentage of spot movement and IV).

b) The Floor Margin, on the other hand, ensures that the account's portfolio always has a minimum coverage. It is calculated by multiplying the net short exposure on the options side (which varies based on the number of contracts sold) by the Unit Floor Margin, a parameter defined and periodically updated by the Aevo team (subject to potential changes in the future). As of now, it corresponds to 0.01 ETH.

Let's consider a bull spread on ETH composed of the following positions:

1x ETH-26AUG22–1500-C Long (IV: 50%, Mark Price: $15.09)

1x ETH-26AUG22–1700-C Short (IV: 70%, Mark Price: $10.92)

Market conditions: Expiry date July 29, 2022 (days to expiry: 1 month); spot price $1,300.

Portfolio Margin:

Scenario margin → $4.52 (worst among the 15 evaluated scenarios)

Floor Margin →

1 × 0.01 ETH = 1 × (0.01 × $1,300) = $131 × 0.01 ETH = 1 × (0.01 × $1,300) = $13

[If the number of contracts sold had been greater, for example, 5, the formula for calculating the Floor Margin would indeed have been:

Floor Margin = 5 × (0.01 × $1,300)

So, in the case of 5 contracts, it would be:

Floor Margin = 5 × $13 = $65]

Maintenance Portfolio Margin = 13 + 4.52 = $17.52

Initial Portfolio Margin = 17.52 × 1.25 = $21.90

c) Liquidation Engine:

The liquidation process begins when the risk engine verifies that an account has violated the following condition:

AB − OO − MM > 0

where:

AB = Account BalanceAB=Account Balance

OO = Total value of Open OrdersOO=Total value of Open Orders

MM = Maintenance Margin of existing positions

For those adopting Aevo's cross-margin portfolio approach, the entire account balance is considered in the evaluation before the liquidation process begins.

During the liquidation process, the Liquidation engine takes control of the account subject to liquidation, preventing the user from executing any operations until solvency is restored.

After each phase of the process, the liquidation engine reassesses the health of the account. If the net worth is still below the maintenance margin, the liquidation engine moves to the next phase.

Open orders on the account are closed incrementally on the order book (and each portion of collateral released is subject to a liquidation fee) through the placement of limit orders every 2 seconds. Aevo applies the liquidation fee to all forced position closure transactions executed on the book.

If the position cannot be liquidated on the order book, the liquidation engine may resort to the insurance fund to cover the net losses caused to the platform by the insolvent trader.

Insurance Fund

Regarding the Insurance fund, the current balance and growth rate are not visible at the moment (a gap that needs to be filled as soon as possible, in my humble opinion). However, the public proposal, approved with a large majority, commits Ribbon DAO to lend 1M USDC to Aevo (as an internally incubated product) at an annual interest rate of 10% for the establishment of the Insurance fund. The loan must be repaid within the year, but both parties have the option to renew the operation through a dedicated governance vote.

Why should Aevo adopt a more transparent approach to the Insurance Fund? Because the purpose of this liquidity “vessel” is ensuring the solvency of the exchange in case of liquidation of accounts with a negative or otherwise unrecoverable balance for any reason (e.g., spreads in order closures, low liquidity in the book, etc.). Large-scale traders, mostly institutional and specialized entities (trading firms, market makers, etc.), rightfully demand proven guarantees of the platform's reliability, measured not only in the efficiency of the risk-liquidation engine but also in the available amount as a backstop.

It continues in part 2..

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^