Aevopedia - Chapter II

Here u will find:

main features of perps on Aevo

OTC section

Automated strategies

Ribbon - Aevo merger

security profile

governance structure

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

What I write simply expresses my personal point of view and does not represent financial advice. But sure, beat me at beer pong and I will tell you the next 100x.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

About perpetuals

Aevo, as we have seen, is a derivatives exchange that goes beyond options and also supports perpetuals. Currently, it integrates 35 perpetual markets, specifically: BTC, ETH, SOL, LINK, TRB, INJ, ARB, TIA, BLUR, MATIC, MINA, MEME, TAO, NMR, DYDX, OP, XRP, PEPE, WLD, BNB, GLMR, SEI, CRV, FRIEND, AVAX, HIFI, STRAX, PRIME, MKR, BLZ, CANTO, SYN, BANANA, OX, and T.

The funding rate is paid to the weaker side of the market every hour and is calculated based on the formula:

The mark price is derived from a range of different prices, all calculated using various formulas (fair price, price 21, and price 2).

Funding is a mechanism unique to perpetual markets (which, as a reminder, have no expiration) designed to maintain the convergence of these contracts' prices with the underlying spot price. When demand increases for one side of a particular market (long or short), it becomes imbalanced and requires a system to restore equilibrium. Funding is essentially a payment made from the stronger side to the weaker side of the market (on Aevo, on an hourly basis) as an incentive to restore balance.

Aevo has various specifications for perpetuals depending on the underlying asset. For assets like ETH, BTC, and most others, the minimum order size is 10 USDC, taker and maker fees are 0.08% and 0.05%, respectively, and the liquidation fee is set at 1% of the notional value of the position. The initial margin is at least 5% of the capital used to open the position, allowing for a maximum leverage of 20x.

For perpetuals on pre-launch tokens (assets whose launch is imminent but has not yet occurred), there are different and more stringent conditions. The initial margin is 50% (maximum leverage of 2x), contract sizes are reduced, and there is no funding rate or index price.

[The FRIEND index is an exotic product that tracks the number of ETH deposited in the Friend.tech smart contract on Base. It converts them into dollars at the spot price of ETH and divides the result by 1,000,000].

About OTC Section:

Aevo OTC adopts an RFQ (Request for Quote) system with an on-chain dynamic margin framework to offer options contracts traded with institutional market makers as counterparts. These contracts have weekly, biweekly, and monthly expiries on 13 different markets, updated monthly based on the popularity of various crypto assets.

This section was introduced to standardize and make trading conditions (and margins) fairer for those interested in vanilla options on altcoins. Previously, traders often had to:

Compare prices on the ask side to guard against manipulation by market makers.

Adhere to strict and opaque rules on margin management.

Aevo OTC allows users to benefit from the same user experience but in a safe and transparent trading environment. Starting mid-August 2023, users can also enjoy the option to unwind their OTC option positions before their natural expiration (previously, they had to wait until the expiration date).

The list of available markets in the OTC section includes: ETH, BTC, BNB, SUI, DOGE, ARB, LDO, APT, LTC, SOL, mATIC, OP, and AVAX.

About Aevo Automated Strategies (Ribbon Vaults):

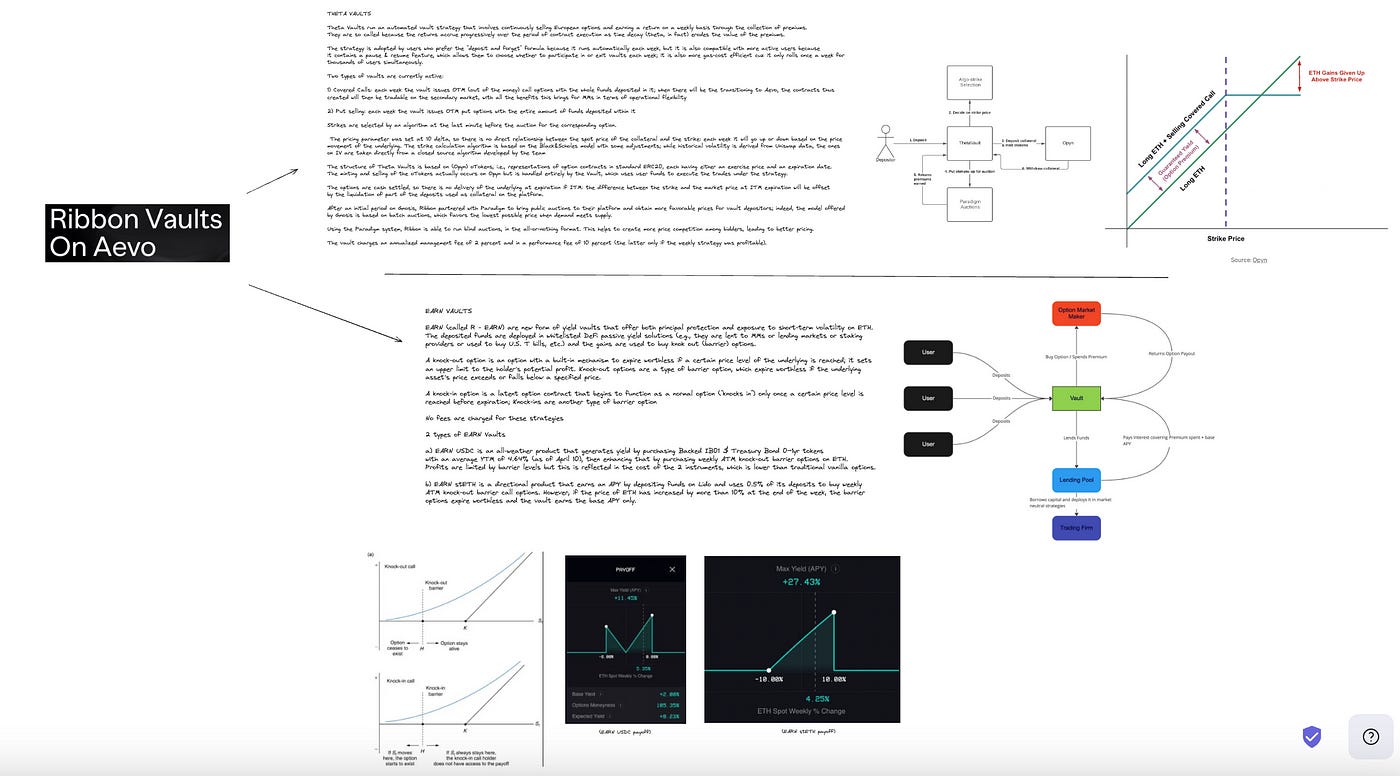

The birth of Aevo realizes Ribbon's ultimate goal of building a dedicated options product that combines the simplicity of Ribbon Decentralized Option Vaults (DOV) with the flexibility of an exchange. During this month (November 2023), there will be a transfer of weekly Ribbon Vaults auctions to Aevo's new "RFQ" (Request for Quote) platform.

Participants will submit their bids in an auction; a prerequisite for participation will be the upfront deposit of funds in USDC.

Once the auction is completed and the best offer selected, the rewards will be transferred from the Aevo app-chain to the Ethereum Mainnet (and sold in WETH or WBTC if the base asset is not USDC) and finally sent to the Vault contract.

Market makers will significantly benefit from this innovation because it offers them the ability to close positions before expiration, something they didn't have before. Previously, they only had participation shares in Vaults on the mainnet, which lacked a dedicated secondary market. Now, their assigned positions are fungible and tradable with other derivatives instruments on the exchange.

Users will also benefit from the operation:

They will now have access to a commission-free trading environment on Aevo, increasing overall profits.

They will have the opportunity to participate in auctions, which are now permissionless (no longer reserved for whitelisted accounts).

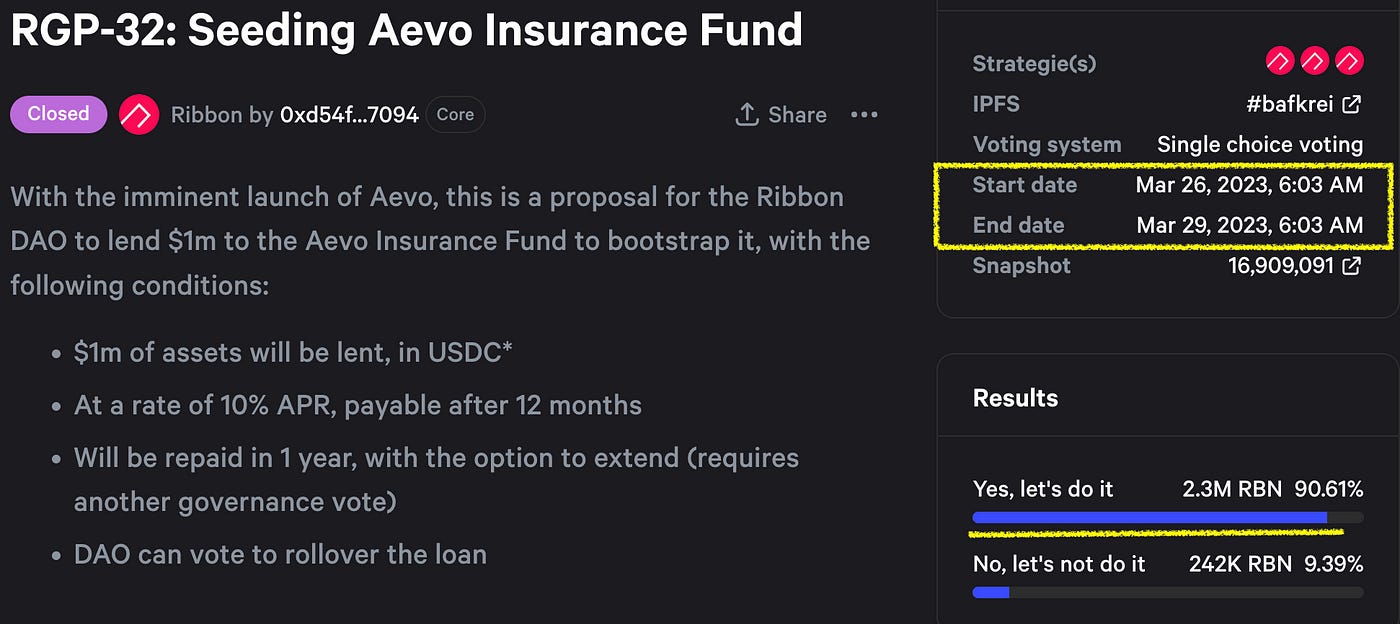

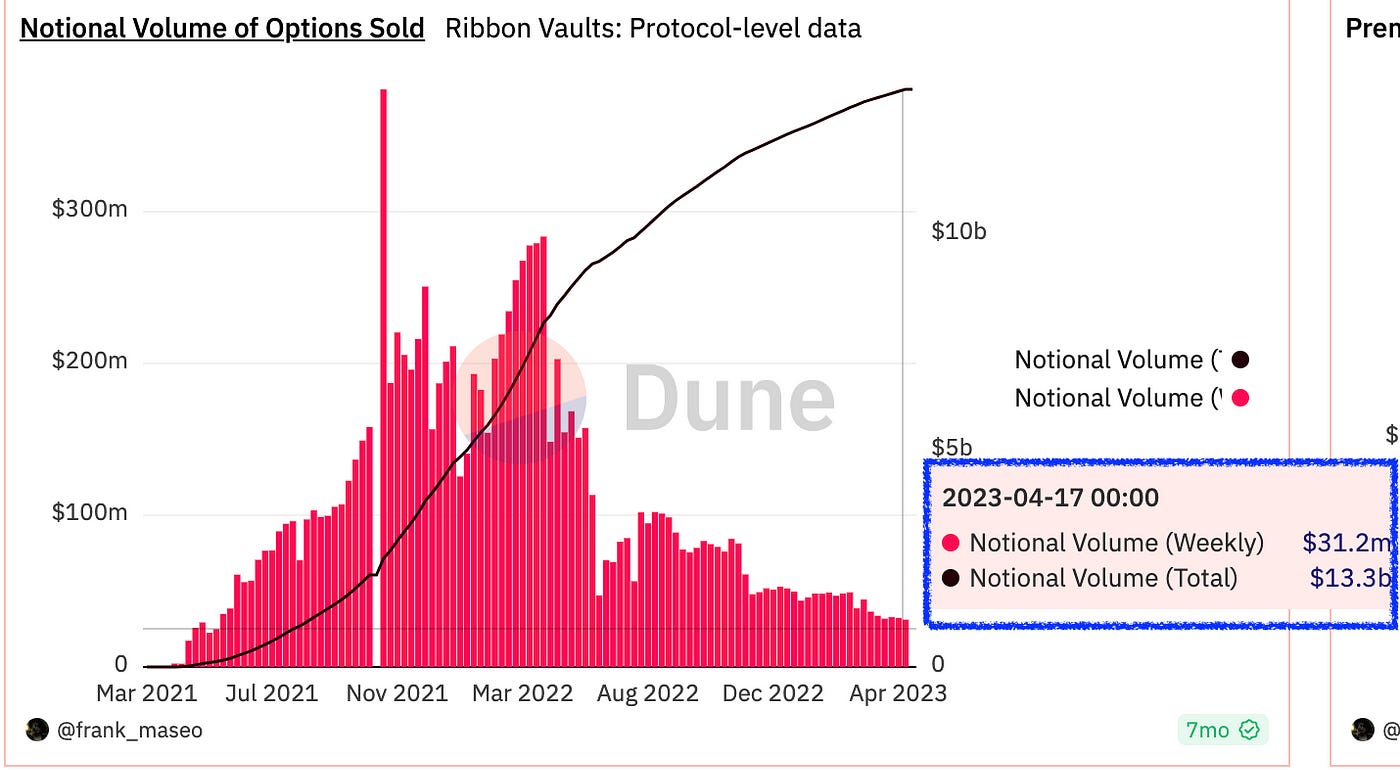

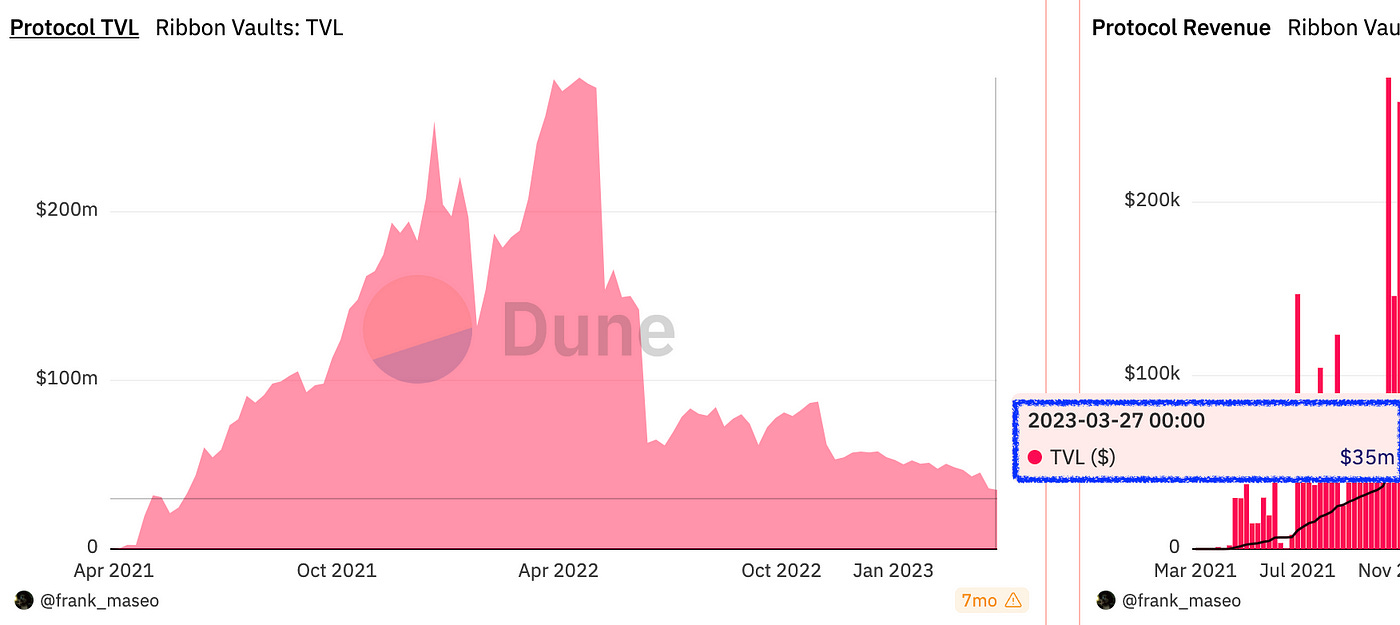

When Ribbon Vaults, currently boasting $35 million TVL and selling over $31 million in ETH and BTC options every week, move their volumes to Aevo, it is expected to positively impact the platform's revenues & user base (according to the basic flywheel: volumes up, more returns, more users).

Ribbon —> Aevo (Merger)

The merger between Ribbon and Aevo is underway and is expected to be finalized by the end of January 2024. Meanwhile, the team has made significant progress in this regard:

Integration of Ribbon Vaults on Aevo: The Ribbon Vaults, also known as automated strategies on Aevo, will be integrated this month (November 2023) on Aevo. This will be followed by the replacement of the website for accessing Ribbon, which will become strategies.aevo.xyz.

Aevo Exchange (Order Book) is Operational: The Aevo exchange, based on an order book, has been operational for several months without encountering issues.

Suspension of Ribbon Tokenomics: The tokenomics of Ribbon has already been suspended, including staking yields and revenues from Vaults for RBN stakers.

Rebranding on Official Social Profiles: Rebranding on official social profiles, such as Discord and Twitter, has already taken place.

What to Expect on Aevo (soon)

Ultimately, on Aevo, we will see the same strategies that were originally on Ribbon but with settlement and execution on the order book rather than through the minting and sale of oTokens (by Opyn).

Soon to be available:

Theta Vaults: Structured products automating the sale of out-of-the-money (OTM) call or put options and the subsequent collection of premiums on a weekly basis.

Earn Vaults: Structured products complementary to Theta Vaults that deposit funds received from depositors into passive yield solutions (such as T Bills tokenized by Backed Finance for USDC and Lido for ETH). They reinvest earned profits and or slight part of the available funds in purchasing knock-out ATM options on a weekly basis. Note: Knock-out options expire without value if, at expiration or during the contract's life cycle, the price exceeds a specific barrier level. Barrier levels are of two types, up and down, marking the maximum and minimum price levels of the underlying asset above/below which the option expires without value.

Treasury Vaults: Theta Vaults private and customizable for DAOs interested in implementing a covered call strategy on their governance token.

Lend Vaults (currently suspended): A service of unsecured loans that allows users to earn interest appropriate to market conditions (and the greater risks associated with the lack of collateral locked as security) by providing liquidity to whitelisted and prestigious borrowers such as Wintermute and Folkvang. This service is currently suspended, and without further notices, it is unclear whether it will be implemented soon or not.

Security Approach

In terms of security, both Ribbon and Aevo contracts undergo thorough audits, and the technical reports are accessible online. For Ribbon contracts, these reports can be found on the website, while Aevo contracts are available on the dedicated GitHub repository.

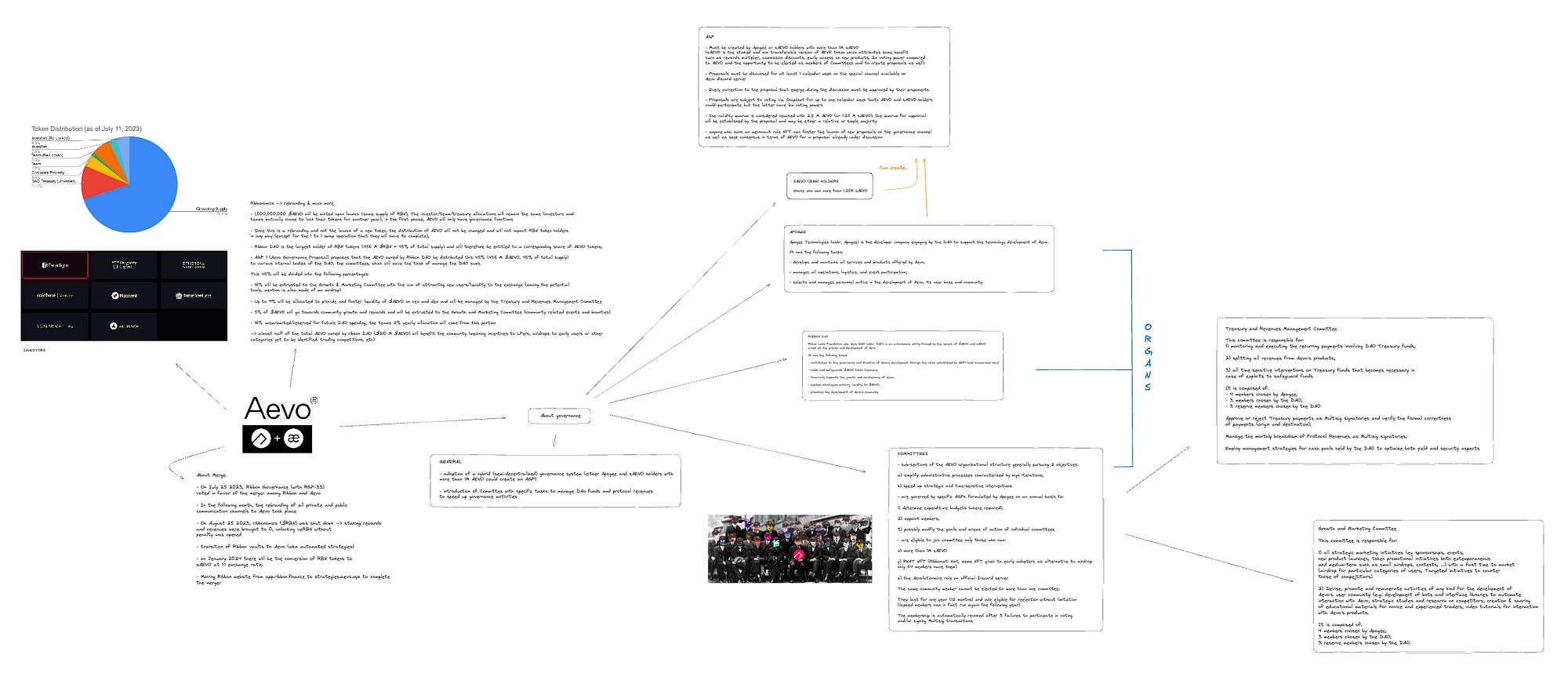

Governance Structure

The first Aevo Governance Proposal (AGP-1) has defined the new governance structure of the protocol. It is structured into various subsections, distributing resources and responsibilities among them. The adopted model is a semi-decentralized hybrid solution, striking a balance between decentralization and swift intervention.

Key actors in this new structure include:

sAEVO Holders: They hold double voting power compared to AEVO holders and have the ability to formulate Aevo Governance Proposals (AGPs) alongside Apogee.

Apogee: The developer company selected by the DAO to support the technological development of the Aevo project.

Committees: These are elective bodies with specific budgets and tasks, serving 12-month terms with the option of renewal. For example, a committee may simplify administrative processes related to financial operations to and from the Treasury or accelerate the implementation of strategic or time-sensitive initiatives.

Ribbon DAO (aka AEVO DAO): An autonomous entity formed by AEVO and sAEVO token holders. Its purpose includes guiding protocol development, safeguarding the treasury, fostering community growth, and providing financial support to the project.

From Ribbonomics to Aevonomics

Minting AEVO Tokens: 1 million $AEVO tokens will be minted at launch with a supply ratio of 1:1 compared to $RBN. Allocations for investors, the team, and the treasury will remain the same, as these tokens will be locked for another year by mutual choice of investors and the team.

Initial Phase Functions: In the initial phase, AEVO will only have governance functions. The distribution of AEVO will not deviate from the initially planned distribution for $RBN, and it will not impact $RBN holders, except for the 1:1 swap operation to complete the conversion from $RBN to $AEVO.

Distribution of AEVO from Ribbon DAO: Ribbon DAO, holding the majority of $RBN (456 million $RBN, 45% of the total supply), is entitled to a corresponding share of AEVO tokens. AGP-1 proposes distributing the $AEVO owned by Ribbon DAO to various internal DAO entities, the Committees, which will manage the funds.

16% for the Growth & Marketing Committee to attract new users/liquidity to the exchange (potential tools include airdrops).

Up to 9% to provide and support AEVO liquidity on centralized and decentralized exchanges, managed by the Treasury & Revenues Management Committee.

5% for community growth and rewards, assigned to the Growth and Marketing Committee.

16% is unallocated or reserved for future expenses that the DAO may incur.

For a summarized overview of tokenomics and DAO elements, refer to the conceptual map below:

Derivatives Data & Analytics

Currently, there is no dashboard that allows the visualization of aggregated data and metrics for both the derivative exchange CLOB (Aevo) and the structured products of Ribbon in a single frontend. Therefore, it will be necessary to manually check on different websites.

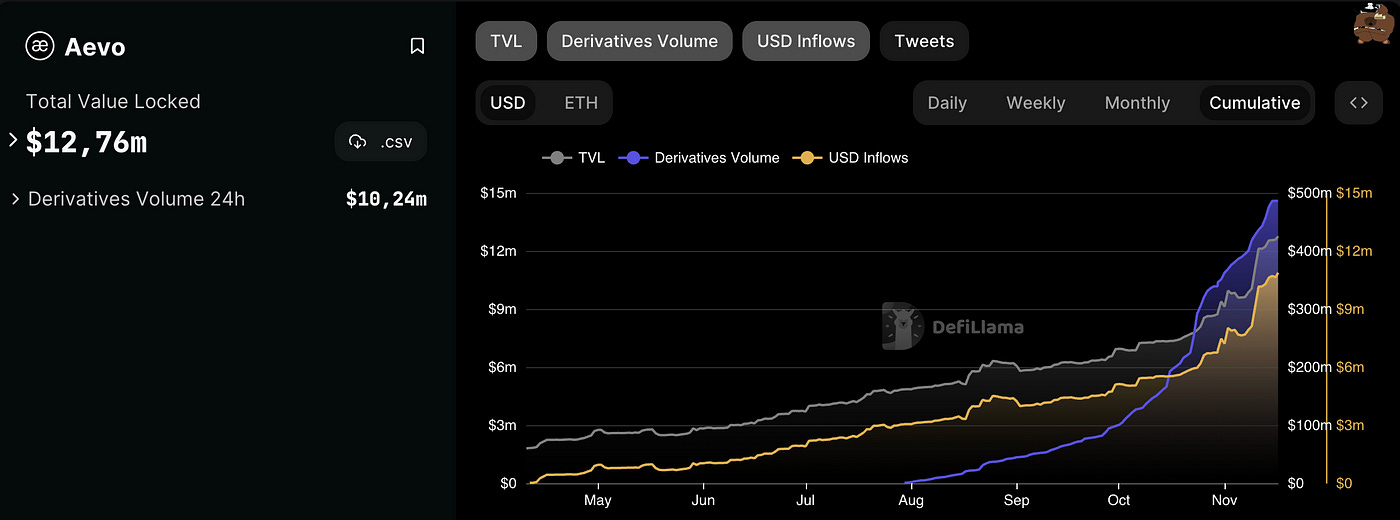

Defillama, under the "protocols" section, displays the Total Value Locked (TVL), weekly, monthly, and aggregated data on perpetuals, as well as inflows in USD on Aevo.

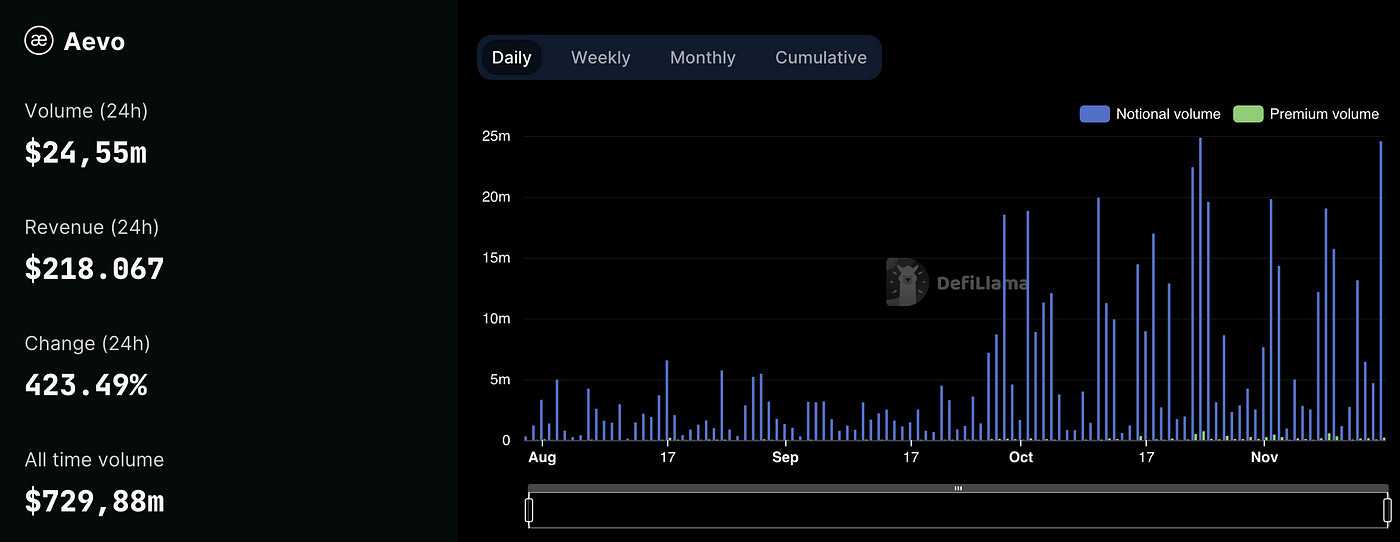

Always on Defillama, by visiting the "options" section under the "volumes" category, you can access data related to the volumes of options on TF (presumably referring to the underlying asset) on a daily, weekly, and monthly basis.

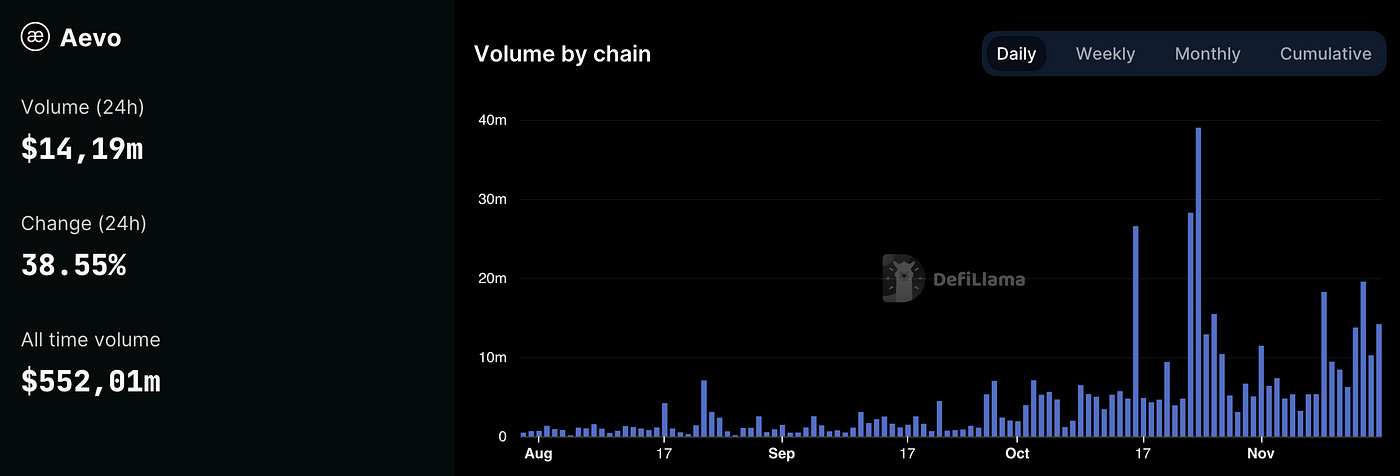

In the "volumes" section of Defillama, specifically under "perpetuals" category, you can find additional useful data on Aevo perp volumes. This information provides insights into the trading activity and volumes associated with perpetual contracts.

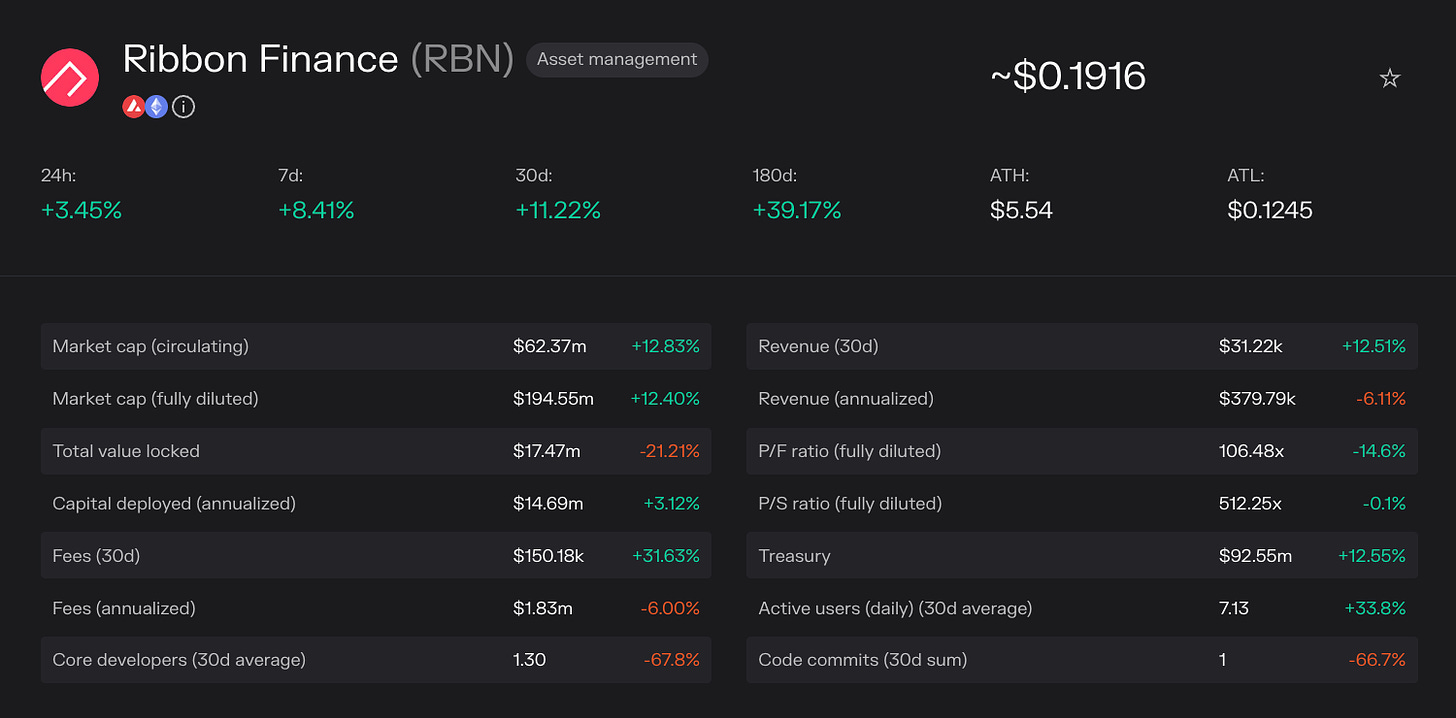

For more detailed data, Token Terminal is a valuable resource. It provides comprehensive information, including treasury funds, price/token ratio, revenues for the past 30 days, and on an annual timeframe. It is important to note that these detailed metrics currently cover only Ribbon Finance and not the Aevo exchange.

It continues in part 3..

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^