Aevopedia - Chapter III

Here u will find:

the last part on derivatives metrics

valuable info about community (social media numbers and roles)

roadmap (some alpha)

some trading strategy

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

What I write simply expresses my personal point of view and does not represent financial advice. But sure, beat me at beer pong and I will tell you the next 100x.

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Laevitas stands out as a key source providing extensive information on Aevo, covering crucial aspects such as option volumes, open interest (OI), distribution among listed assets, implied volatility (IV) term structure on at-the-money (ATM) options, and more. However, access to historical data or viewing information on different time frames beyond the default setting may require a subscription to their premium plan.

It's worth noting that a promising dashboard containing all the essential statistics for Aevo has recently become accessible to the public (as of 16/11/23). You can find it at this link.

Combining data from various sources, some general observations can be made:

a) Option volumes on Aevo tend to peak between Wednesday and Friday (expiry days) and experience a noticeable decline from Saturday to Tuesday.

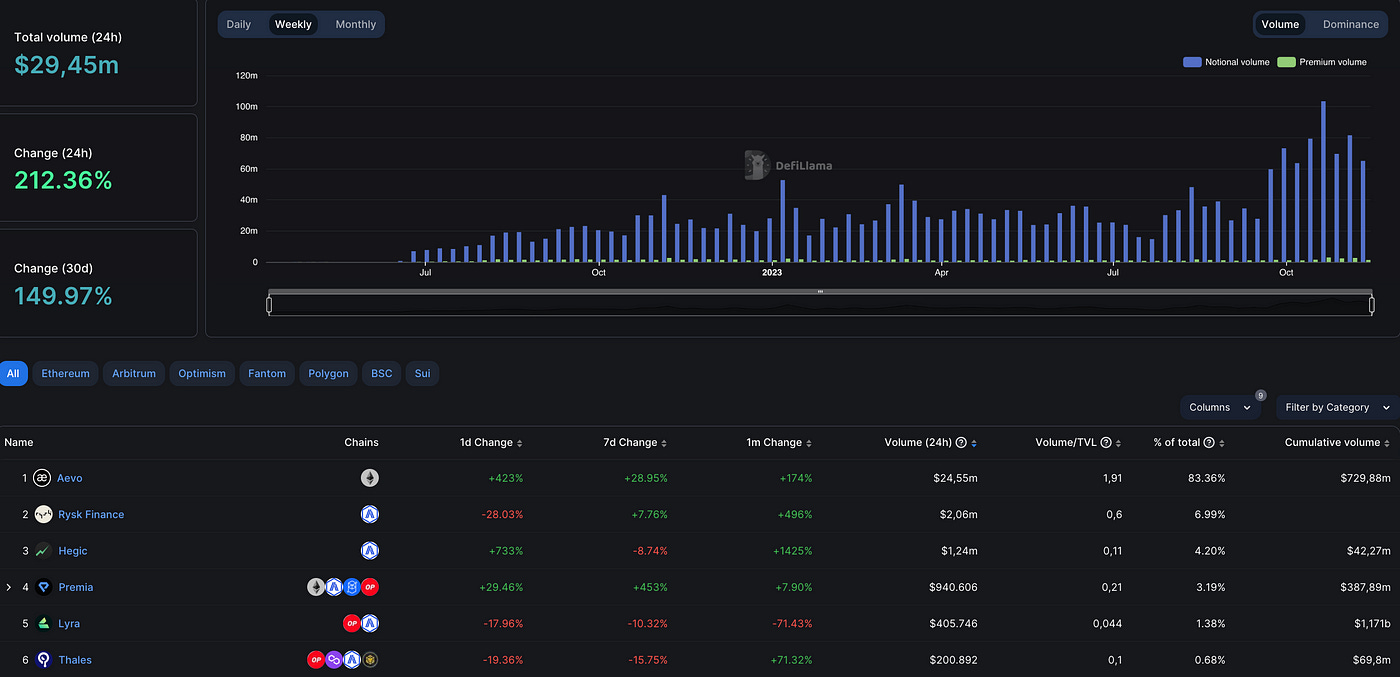

b) Since early October, overall option volumes on the protocol have witnessed significant growth. Aevo has established itself as the leader in the TVL (Total Value Locked) category for options, showing a substantial lead over the second-ranking platform. However, given the nascent and evolving nature of the sector, with low utilization and ongoing development, identifying a definitive leader is challenging. A modest influx of capital into either protocol could potentially reshape the rankings.

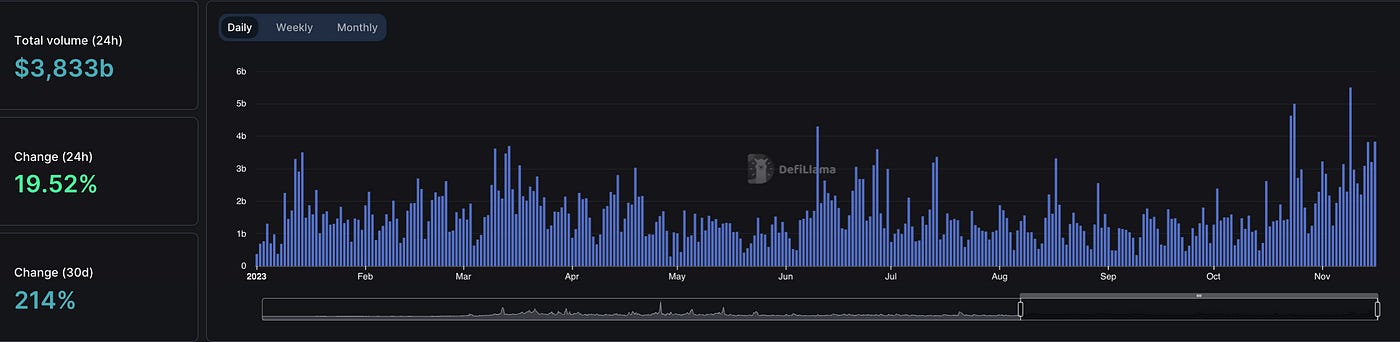

c) Regarding perpetuals, volumes have experienced modest growth since October. However, they still remain significantly lower compared to those generated on leading market platforms such as GMX and Kwenta. It's important to note that the graph doesn't include data from DYDX, which serves as the true benchmark for perpetual decentralized exchanges (Dexes).

It is worth noting that the dune chart above does not include data from DYDX, the true benchmark for perpetual decentralized exchanges (Dex) with its impressive average daily volume of $1 billion (!!!).

d) Theta Vaults are expected to generate a significant volume on Aevo's options book, estimated at 15–16 million on a weekly basis, with an average daily volume of 10 million and a weekly volume of nearly 70 million (about a 20% net growth). This will improve overall liquidity on the order book, and the yields of the Vaults will also increase (no longer subject to the 4 bps fees previously applied by Paradigm for access to their bind auctions system).

About Community

The Aevo community largely consists of the old friends of Ribbon, but it is expected to grow over time based on the protocol's performance and the success of marketing initiatives conducted by the related Committee.

On Twitter, the official Aevo profile has 26K followers (a significant drop from Ribbon's previous 41K), and there are 24K members on Discord.

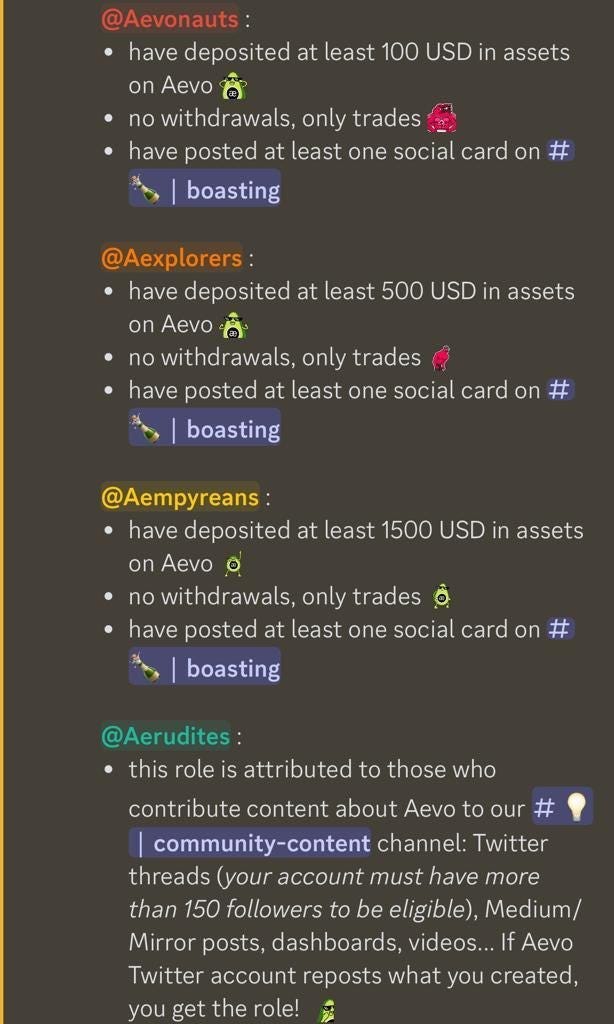

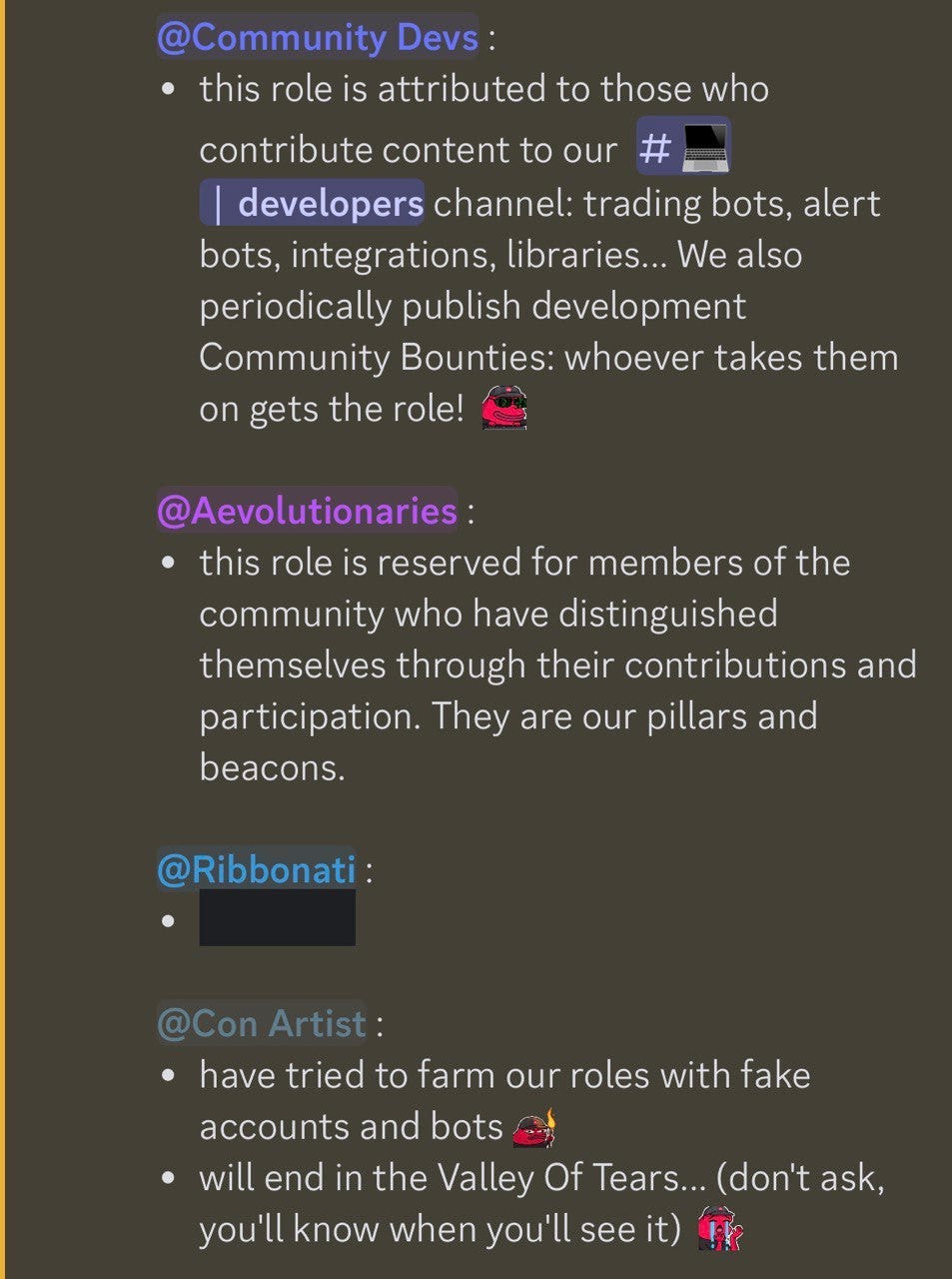

All project-related discussions take place in various sections of the Discord channel, and the team places great importance on "roles," assigning roles on the social platform based on the contributions made by users. Currently, access to roles is suspended and will reopen in the future. To join, users will need to fill out the form attached here. It is unnecessary to inquire on Discord, as a bot will intercept your message and prevent it from being visible to other users.

Here is the list of available roles and the tasks required to obtain them:

In the FAQ section on Discord (get - roles channel), some of the main doubts regarding roles are clarified:

Inactive accounts (simple passive deposit without trading) will lose the corresponding role but can always recover it in the future.

If the account balance falls below the required threshold for role access, the user will not lose it, as long as they haven't made a fund withdrawal (an action that penalizes the user, moving them to the role corresponding to the new balance).

Roles are currently subject to manual verification (in the future, procedures will be automated). Therefore, the form must be re-submitted for each role change, and any modifications will take some time before being implemented.

Roadmap (what we could expect in the near future)

A mobile app for trading on Aevo via smartphones, as hinted by Julian (co-founder of Aevo).

a dashboard updated in real time with aggregated data on options and perps (released yesterday, 11/16/23, and available here);

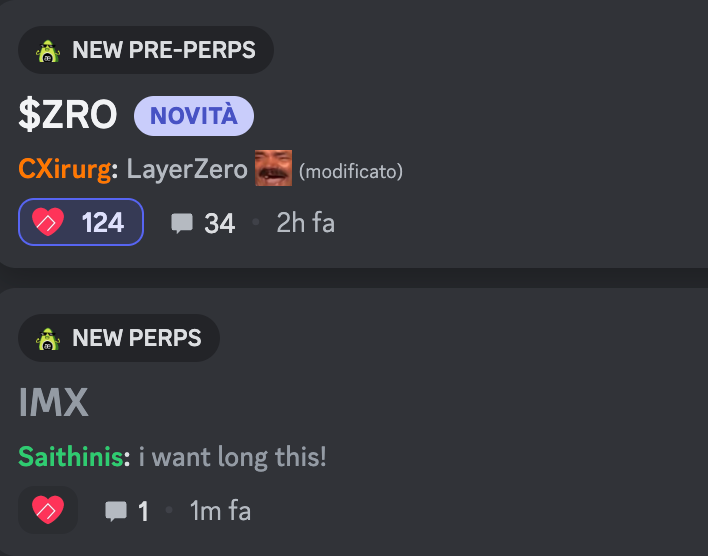

FXS and ZRO should soon be listed (as Pre-launch tokens)

Partial (and multiple) take profits, isolated margin, and automated strategies are about to be introduced.

Mastering derivatives — actionable strategies

Now that the main features of the exchange are clearer, let's see what can be done with the respective products.

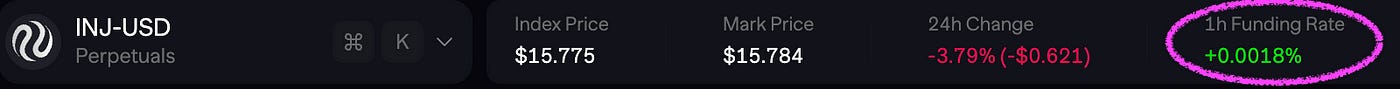

Delta-neutral positions (aka cash & carry trade) aiming to capture spreads on funding between different perpetual platforms. For example, in this market context, the funding on Aevo and Kwenta (another perpetual DEX, but on the Optimistic Ethereum network and using SNX) has opposite signs on the same asset, INJ: if we open a long position on Kwenta and an equally sized short position on Aevo, we would be neutral in terms of delta and could earn interest:

— 0.2472% daily (0.0103 x 24h) on the long side, 90.22% annualized

— 0.0432% daily (0.0018 x 24h) on the short side, 15.6% annualized

90.22% + 15.66 = 105.88% annualized on a delta-neutral position.

Note: These opportunities continuously arise in perpetual markets (it is also true that they do not last long) and are undoubtedly more numerous in DeFi due to the endless proliferation of protocols in this category (and the resulting fragmentation of liquidity). In case one of the two sides offers an excessively high funding rate but there are no conditions to open a position on the opposite side (because, for example, there are no significant spreads among perp dexes, the markets are saturated and it is not possible to open trades, etc.), it is possible to change:

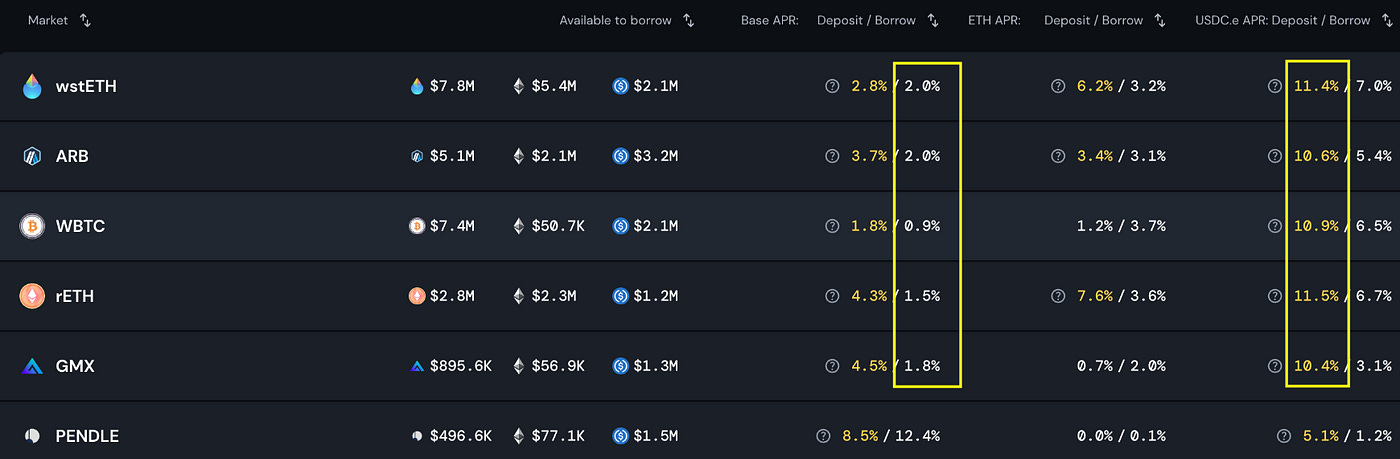

— the long side with spot positions in single-side pools (such as those available on Pendle, Aave, Morpho, Yearn, Compound, Silo, Ipor, etc.)

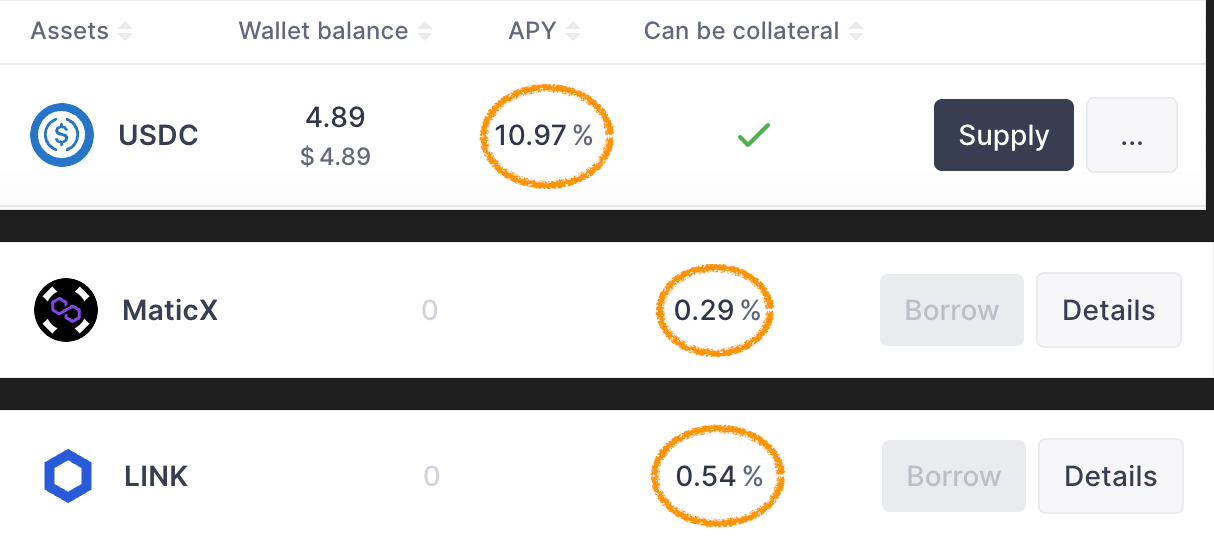

— the short side with positions on lending markets, depositing stables on lending side, borrowing the relevant asset, and then swapping it for USD. Here are a couple of examples, the first on the Ethereum network and the second on Polygon.

It continues in part 4..

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^