Mastering perp dexes - Part III

Then there are the Central Limit Order Book (CLOB based) models, which are in turn divided into:

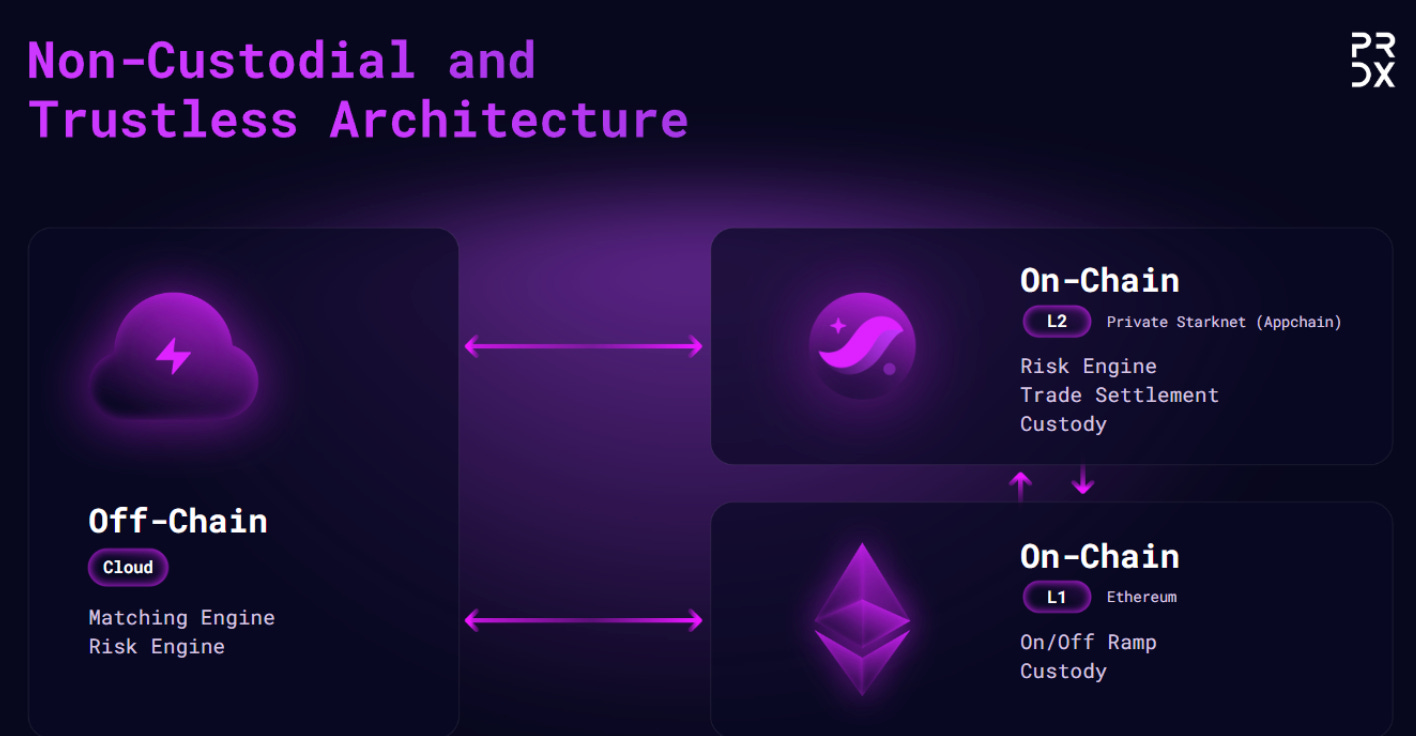

a) hybrids, because they have matching engine and book off chain while performing trades settlement on chain. One of the most representative protocols in this subcategory is @tradeparadex, an order book derivatives exchange running on dappchain (zk rollup Starknet Stack based) with one of the most advanced risk engine systems in the whole industry and virtually instantaneous execution speed.

Unique features:

risk engine extremely optimized for capital efficiency on derivatives trading

almost instant execution speed

Insanely high throughput ensured by the Starknet stack

trading is facilitated by one of the largest MM networks in the whole crypto space

b) fully on chain, because they keep both book and settlement on chain (although the level of decentralization is not always as high as one might think, because other key factors such as the sequencer, the network of nodes of the underlying chain, etc have to be evaluated). The most interesting projects in the subcategory are:

b1) @HyperliquidX, a fully on-chain order book perp exchange built on an L1 PoS built from 0 that uses a custom version of Tendermint optimized to provide end-to-end latency of less than 1 second and capable of processing 20K txns per second.

Unique features:

outstanding performance (incredible throughput and latency)

Protocol Vaults as automated LPing solutions on the book running MM strategies set by the team; in the future, deployment of vault strategies will be permissionless

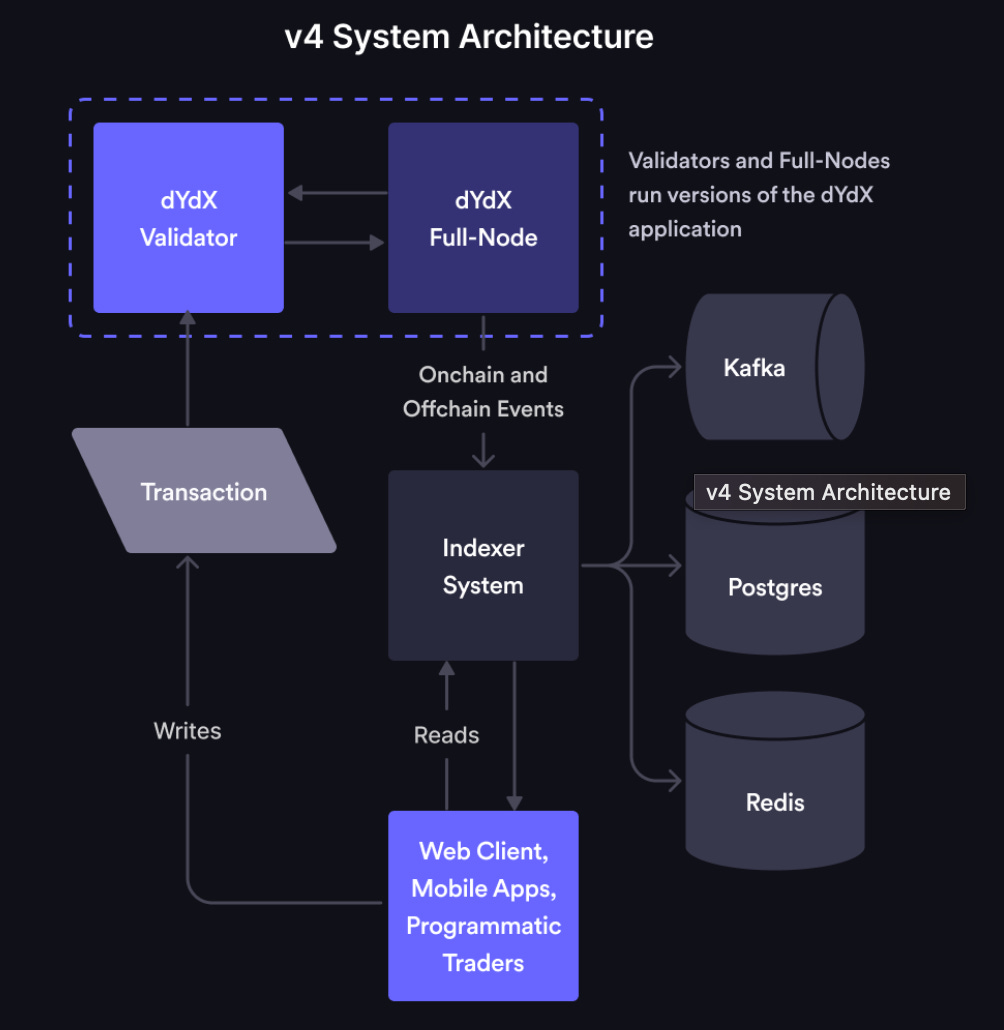

b2) @dYdX, open-source app-specific blockchain software (built on CometBFT using the Cosmos SDK and written in Go) powering a decentralized end-to-end and fully on-chain perp exchange (technically speaking, orders are stored within an in-memory order book, that is off-chain and on which there is no consensus). It is undoubtedly one of the best designed products in the whole perp space and for all competitors undoubtedly the opponent to beat.

Unique features:

Extremely high performance

very deep liquidity ensured by a high-level MM network

outstanding UX

Cutting edge risk and liquidation engines

The fourth category is represented by hybrid models, i.e. those projects which combine multiple solutions while triyng to capture the best of each. Among the most fascinating designs i must mention:

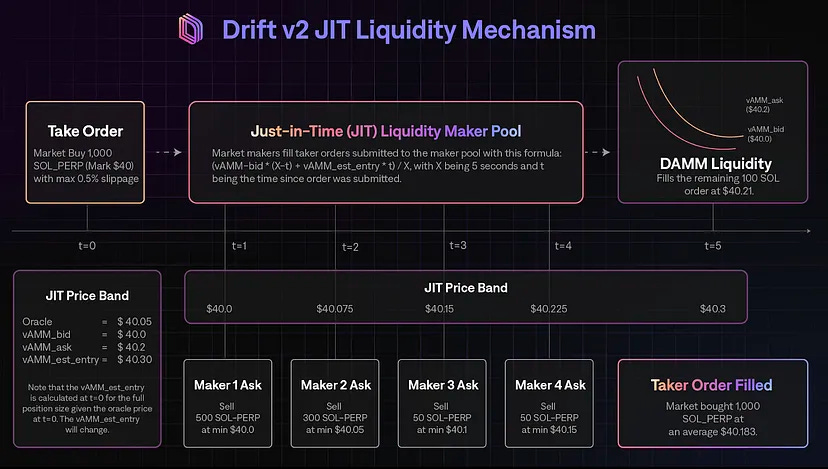

a) @DriftProtocol, a hybrid perp exchange with an extremely innovative design leveraging 3 different models by efficiently coordinating them with each other:

Dutch Just In Time (aka short-term) auctions, in which market orders are placed;

Dynamic vCFMM model as a backstop solution for trade handling that acts if: 1) market orders are not fulfilled by MMs - Keepers through JIT auctions and 2) Resting orders reach a trigger price that can be fulfilled by the AMM;

A DLOB (aka decentralized order book) mainly dedicated to limit orders management.

Unique features:

Optimal order management across supported designs

the design itself

high performance thanks to the stack designed by the team and the chain chosen as the development environment, Solana

wide range of offered services (spot markets, spot limit orders, lend / borrow, LPing interesting solutions such as MM vaults, leverage staking derivatives, etc.)

b) @vertex_protocol, a universal cross-margin, decentralized, multi-service infra (with integrated spot trading and money markets) with a hybrid model, combining an off-chain sequencer for order matching that acts as a CLOB, a fully on-chain and protocol-integrated constant-product AMM, and a fully on-chain risk engine system

Unique features:

Edge, a custom parallel EVM implementation of an off chain order book written in Rust designed to unify cross chain liquidity

A cutting edge design

c) @SynFuturesDefi, which has created an innovative hybrid liquidity paradigm (called Oyster AMM) that combines the capital efficiency of a fully on-chain order book and concentrated liquidity provided by LPers with a comprehensive and advanced risk and liquidation management framework

Unique features:

advanced financial risk management mechanisms to enhance user protection and price stability (such as a dynamic penalty fee system discouraging price manipulation by imposing penalties for significant deviations between trade prices and mark prices)

Single-Token Concentrated Liquidity

Native Irreversible Limit Orders on Oyster AMM

The remaining category we need to look at is that of aggregation protocols, which as the word suggests aggregate liquidity from different sources to provide a qualitatively better trading experience. The protocols that most caught my attention are:

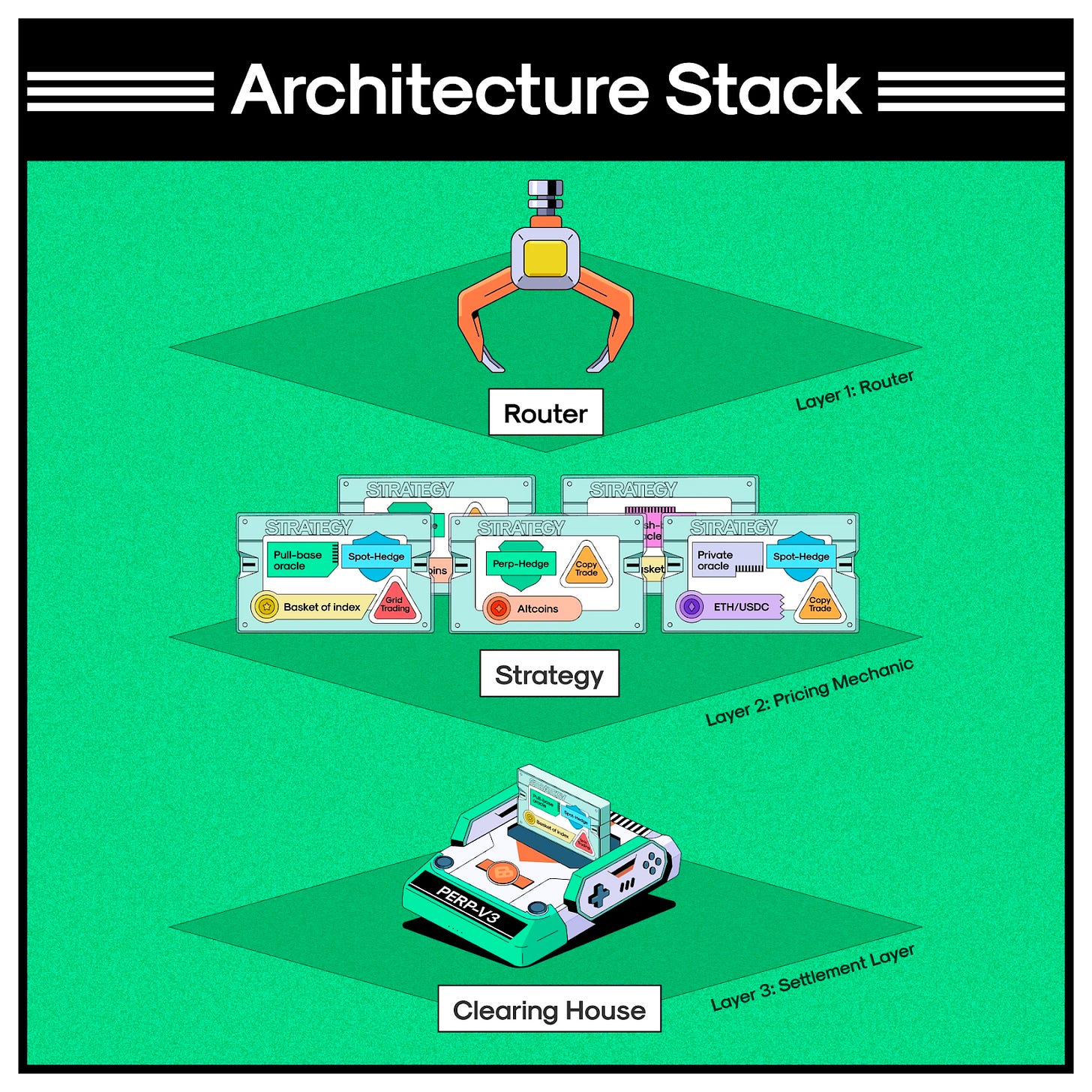

a) Perp Protocol and its latest iteration, V3, which introduces the Smart Liquidity Framework, an entire 3-tier stack consisting of: the Router (which is customizable by users), which ensures that users get the best prices for their orders by automatically choosing the strategy that offers the best available price; the pricing mechanics (strategy layer), which determines how liquidity is to be provided and at what price; and the Clearing House (the settlement layer), which records all traders' orders with their prices, guards all collateral, and manages settlements to ensure the financial security of the platform.

Unique features:

full stack

modular design

unparalleled flexibility (it allows users to automate unique trading strategies fully on-chain for e.g.)

b) Rage Trade is a next-generation multi-chain aggregator of perpetual dexes that combines the privileges associated with AA (Account Abstraction) with the needs of traders in DeFi to offer a state-of-the-art product capable of:

support much more complex strategies and/or trades than traditional ones

equalize the UX to that of cex (perhaps even improve it)

Aggregate liquidity across multiple platforms through predefined or customizable paths (at the user's discretion), so as to minimize excess costs while benefiting from the most favorable funding

Unique features:

supports all compatible L2 EVMs (including dappchains like Aevo e.g.) and is working on integrating Cosmos and Solana

adopts the AA solution developed on top of Biconomy SDK (authoritative and knowledgeable provider, backed by Coinbase), which has a modular nature design (i.e., is designed to continuously integrate new features as plugins) and is erc 4337 compliant

introduces the gas tank (one of the Biconomy SDK features), a kind of tank from which each chain draws to repay the gas cost of txns and which any user can easily top up on any supported chain

introduces session based trading (another feature of the SDK), which allows users to trade on the platform without signing each individual txn

^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^^

Now that you know all the different models and how to evaluate them, there is only one thing left to do:

study to figure out which of them is the best (or wait for the next perps related giga research that Rakki will create, your choice).